How to Get on the Property Ladder: Your Friendly Guide

Hey there! So, you’re dreaming of owning your own place. The idea of hanging up that “Home Sweet Home” sign is pretty exciting, right? But where do you even start? Getting on the property ladder can seem a bit daunting, but don’t worry! We’re here to break it down in a way that’s super easy and friendly.

1. Know Your Stuff: Understanding the Basics

Before diving headfirst into house hunting, let’s get familiar with the basics. The property ladder usually consists of a few rungs: starting from renting, moving to buying a starter home, and eventually upgrading to your dream home. Each step has its own challenges and rewards.

2. Save, Save, Save!

First up, saving money is key! If you want to buy a house, you’ll likely need a deposit. A typical deposit is around 10-20% of the home’s value, depending on the mortgage you’re applying for. So, let’s say you’re eyeing a home worth £300,000. You’d need £30,000 to £60,000 just for the deposit. Scary, right? But don’t let that deter you! Start by setting a budget and see where you can trim the fat. Maybe cut back on those fancy coffees or that subscription you never use. Every little bit helps!

3. Boost Your Credit Score

Another important factor is your credit score. Think of it as your financial report card. Lenders will look at your score to decide how much money they’re willing to lend you and at what interest rate. To improve your score, pay your bills on time, reduce credit card balances, and avoid opening too many new accounts. Check out free credit report services to keep an eye on your progress!

4. Research Your Options

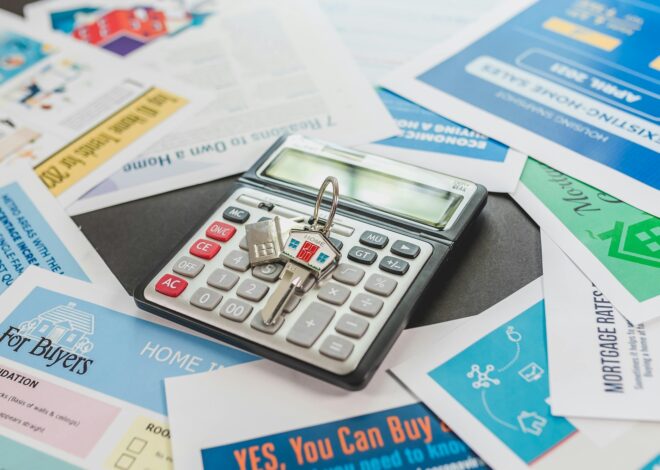

When you’re ready to start looking, it’s time to research your options. Have a chat with a mortgage advisor who can walk you through the different mortgage types – fixed-rate, variable, or first-time buyer schemes. Getting the right mortgage can save you a heap of money in the long run.

5. Find the Right Property

Next, it’s house-hunting time! Make a list of what you want in a home. Think about the number of bedrooms, proximity to work, local schools, and amenities. Use online portals to see what’s available in your desired area. Remember, it’s okay to start small; many first-time buyers opt for cosy apartments or starter homes.

6. Get a Real Estate Agent

Having a real estate agent by your side can make life so much easier. They know the market inside out and can help you find properties that suit your needs. Plus, they’ll guide you through negotiations and paperwork, which is a huge relief!

7. Secure that Mortgage

When you’ve found ‘the one,’ it’s time to secure your mortgage. Gather all your necessary paperwork—like proof of income and bank statements—and let your lender do their magic. Just remember to read the fine print before signing anything!

8. Offer, Accept, Move In!

Once your mortgage is secured and you have a good feeling about a property, make your offer. If it’s accepted, congratulations! You’re officially on your way to homeownership. After some closing processes, the keys are yours!

Final Thoughts

Jumping on the property ladder isn’t always a walk in the park, but it’s more than achievable with the right planning and a bit of patience. Whether you’re dreaming of a cosy apartment or a family home, take it step by step and remember, every homeowner was once in your shoes! Happy house hunting! 🚪🏡✨